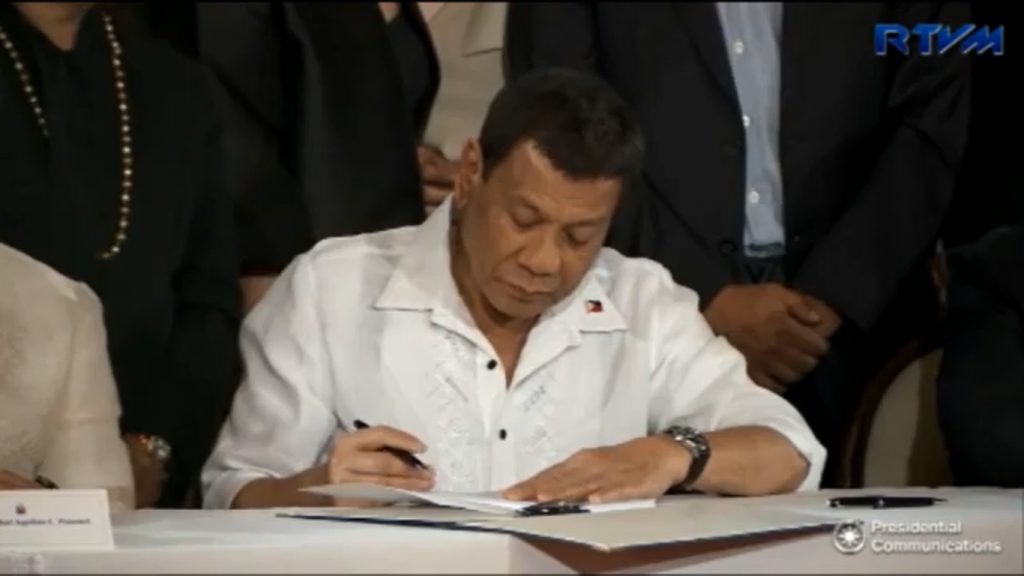

- President Rodrigo Duterte signs TRAIN Act into law

- New measure reduces tax burden of Filipinos

President Rodrigo Roa Duterte signed into law Republic Act 10963, otherwise known as the “Tax Reform for Acceleration and Inclusion (TRAIN) Act, which reduced the tax burden of common Filipino taxpayers.

Individuals earning an annual net income not over P250,000 shall now be tax-exempt effective January 1, 2018.

Also, filing of income tax return for those earning not over P250,000 annually is no longer required.

The new law further increased the ceiling of tax exclusion of 13th month pay and other benefits to P90,000.

Previously, self-employed and professionals pay a graduated income tax at the rate of 5% to 32%. With TRAIN, self-employed individuals and professionals shall have the option to avail of an 8% tax on gross sales or gross receipts in excess of P250,000 in lieu of the graduated income tax rates.

Estate tax on decedents is also amended to a single tax rate of six percent based on the value of the net estate. The standard deduction is likewise increased to P5M, while the value of the family home exemption is increased to P10M.

The estate tax can now be paid within a year and an installment within two years is provided.

TRAIN likewise increases the VAT exemption on monthly rentals from ₱10,000 to ₱15,000.

TRAIN is the first package of the Duterte administration’s comprehensive tax reform program aimed to raise revenues for the government to provide sufficient funding for infrastructure and social services programs.